It is difficult to establish any rigid guidelines for designating the entity of a governmental body. Due to the variety in the form of these entities, the examining attorney must consider each case on an individual basis. The following are just a few examples of acceptable governmental entities:

Department of the Air Force, an agency of the United States.

Maryland State Lottery Agency, an agency of the State of Maryland.

City of Richmond, Virginia, a municipal corporation organized under the laws of the Commonwealth of Virginia.

These examples are not exhaustive of the entity designations that are acceptable.

The structure of educational institutions varies significantly. The following are examples of acceptable university entities:

Board of Regents, University of Texas System, a Texas governing body.

University of New Hampshire, a nonprofit corporation of New Hampshire.

Auburn University, State University, Alabama.

These examples are not exhaustive of the entity designations that are acceptable.

The designations "education institution" and "educational organization" are not acceptable. If the applicant uses either of these designations to identify the entity, the examining attorney must require the applicant to amend the entity designation to a legally recognized juristic entity.

The nature of banking institutions is strictly regulated and, thus, there are a limited number of types of banking entities. Some banking institutions are federally chartered while others are organized under state law. The following is a non-exhaustive listing of examples of acceptable descriptions of banking institutions:

First American Bank of Virginia, a Virginia corporation.

Pathway Financial, a federally chartered savings and loan association.

Most states recognize an entity commonly identified as a "limited liability company" or "LLC." The entity has attributes of both a corporation and a partnership. Therefore, the USPTO will accept "limited liability company" as an entity designation. The examining attorney may accept appropriate variations of this entity, with proof that the entity exists under the law of the relevant state. For example, some states recognize an entity identified as a "low-profit-limited-liability company" or "L3C," which combines the features of a for-profit LLC and a nonprofit organization.

If "LLC" or "L3C" appears in the applicant’s name, but the entity is listed as a corporation, the examining attorney must inquire as to whether the applicant is a limited liability company or a corporation.

The applicant must indicate the state under whose laws the limited liability company is established. It is not necessary to list the "members" or owners of the limited liability company when identifying the entity.

See TMEP §611.06(g) regarding the proper party to sign a response to an Office action filed by a limited liability company that is not represented by an attorney.

Limited Liability Corporation. A business organization known as a "limited liability corporation" is currently not recognized in any jurisdiction. If an applicant’s entity type is identified as a limited liability corporation, the examining attorney must inquire as to whether the applicant is a limited liability company or a corporation. If the applicant believes that it is a limited liability corporation, then the applicant must provide proof that such a legal entity exists under the appropriate state statute.

See TMEP §803.03(c) regarding use the use of "Limited" or "Ltd." in a corporation name and §803.03(k) regarding limited liability partnerships.

In designating the legal entity type of foreign applicants, acceptable terminology is not always the same as for U.S. applicants. The word "corporation" as used in the United States is not necessarily equivalent to juristic entities of foreign countries; the word "company" is sometimes more accurate. If the applicant is from the United Kingdom or another Commonwealth country (e.g., Canada or Australia) and the term "company" (or the abbreviation "co.") is used, no inquiry is needed. "Limited company" is also acceptable, for example, in China, the Republic of Korea, and Commonwealth countries. There is a list of Commonwealth countries on the commonwealth website at https://thecommonwealth.org/our-member-countries.

"Limited corporation" is also an acceptable entity designation for a foreign applicant.

The designation Foreign Maritime Entity (FME) is not an acceptable business entity type. A "legal entity" is "[a] body, other than a natural person, that can function legally, sue or be sued, and make decisions through agents." Black’s Law Dictionary (11th ed. 2019). Here, the capacity to sue or be sued rests with the foreign entity that registers as a FME, as opposed to the FME itself. Therefore, the term FME does not identify a legal entity.

Appendix D of this manual lists common foreign designations, and their abbreviations, used by various foreign countries to identify legal commercial entities. The appendix also includes a description (Joint Stock Company, Cooperative Society, Trading Partnership, etc.) of the foreign designation and, in some cases, the equivalent U.S. entity. If a foreign designation, its abbreviation, or a description appears in the appendix, the examining attorney may accept any of those terms as the entity designation without further inquiry. The applicant may also choose to specify the legal entity by indicating the entity that would be its equivalent in the United States. However, if an applicant identifies itself by a name that includes a foreign entity designation in Appendix D (e.g., "Business SpA"), but provides a characterization of the entity that does not match the description (e.g., General Partnership), the examining attorney must clarify the nature of the applicant’s entity.

If a foreign entity designation, its abbreviation, or its description does not appear in Appendix D, the examining attorney must inquire further into the specific nature of the entity. The examining attorney may request a description of the nature of the foreign entity, if necessary.

For foreign entities, the applicant must also specify the foreign country under the laws of which it is organized. The applicant, however, is not required to provide other information even if additional information would be required for a U.S. entity of the same name. For example, it is not necessary to set forth the names and citizenship of the partners of a foreign partnership. The rule requiring names and citizenships of general partners in domestic partnerships (37 C.F.R. §2.32(a)(3)(iii) ) seeks to provide relevant information in the record, given the legal effects of partnership status in the United States. Because the USPTO does not track the varying legal effects of partnership status in foreign countries, and the relevance of the additional information has not been established, the same requirement for additional information does not apply to foreign partnerships.

Foreign entities may be organized under either national or provincial laws. However, the TEAS form requires an applicant to specify the state or foreign country under which it is legally organized, but does not permit an applicant to specify a foreign province or geographical region in this field. Therefore, if the applicant is organized under the laws of a foreign province or geographical region, the applicant should select the entity type "Other" (rather than "Corporation," "Limited Liability Company," "Partnership," etc.), which will allow entry within the free-text field provided at "Specify Entity Type" of both the type of entity and the foreign province or geographical region under which it is organized (e.g., enter "corporation of Ontario" in the box labeled "If not listed above, please specify here:"). In the next section, "State or Country/Region/Jurisdiction/U.S. Territory Where Legally Organized," the country (e.g., "Canada") should then be selected from the pull-down menu.

A federally recognized Indian tribe, organized under the laws of the United States, is an acceptable designation of an applicant’s entity.

Most states recognize an entity commonly identified as a "limited liability partnership" ("LLP"). An LLP is separate and distinct from a limited partnership, and is more closely associated with a limited liability company in that it has attributes of both a corporation and a partnership. Therefore, the USPTO will accept the entity designation "limited liability partnership." The examining attorney may accept appropriate variations of this entity (e.g., "limited liability limited partnership" or "LLLP"), with proof that the entity exists under the law of the relevant state.

The applicant must indicate the state under whose laws the limited liability partnership is established. It is not necessary to list the partners of the limited liability partnership when identifying the entity.

See TMEP §611.06(h) regarding the proper party to sign a response to an Office action filed by a limited liability partnership that is not represented by a qualified practitioner.

See also TMEP §803.03(c) regarding the use of "Limited" or "Ltd." in a corporation name and §803.03(h) regarding limited liability companies.

An application for registration must specify the applicant’s citizenship or the state or nation under whose laws the applicant is organized. 37 C.F.R. §2.32(a)(3)(i)-(ii). If ambiguous terms are used, the examining attorney must require the applicant to clarify the record by setting forth the citizenship with greater specificity. For example, the term "American" is ambiguous because it could refer to a citizen of North, South, or Central America. Therefore, "United States," "United States of America," or "U.S.A." is the appropriate citizenship designation for applicants who are citizens of the United States of America. However, terms such as "Brazilian," Colombian," and "Welsh" are acceptable citizenship designations because each refers to a specific country.

An individual applicant should set forth the country of which he or she is a citizen. Current citizenship information must be provided; a statement indicating that the applicant has applied for citizenship in any country is not relevant or acceptable. If an individual is not a citizen of any country, a statement to this effect is acceptable.

If an individual applicant asserts dual citizenship, the applicant must choose which citizenship will be published in the Trademark Official Gazette and included on the registration certificate. The USPTO will publish and include only one country of citizenship for each person in the Trademark Official Gazette and on the registration certificate, and the automated records of the USPTO will indicate only one country of citizenship for each person.

For a sole proprietorship, the application must set forth the state of organization of the sole proprietorship and the name and citizenship of the sole proprietor. 37 C.F.R. §2.32(a)(3)(v).

For a corporation, the application must set forth the U.S. state or foreign country of incorporation. 37 C.F.R. §2.32(a)(3)(ii).

Foreign entities may be organized under either national or provincial laws. However, the TEAS form requires an applicant to specify the state or foreign country under which it is legally organized, but does not permit an applicant to specify a foreign province or geographical region in this field. Therefore, if the applicant is organized under the laws of a foreign province or geographical region, the applicant should select as the entity type the choice of "Other," which will allow entry within the free-text field provided at "Specify Entity Type" of both the type of entity and the foreign province or geographical region under which it is organized (e.g., "corporation of Ontario"). In the next section, "State or Country Where Legally Organized," the country (e.g., "Canada") should then be selected from the pull-down menu.

For an association, the application must set forth the U.S. state or foreign country under whose laws the association is organized or incorporated. 37 C.F.R. §2.32(a)(3)(ii); see TMEP §803.03(c).

A partnership or other firm must set forth the U.S. state or foreign country under the laws of which the partnership is organized. 37 C.F.R. §2.32(a)(3)(ii). Domestic partnerships must also provide the name and citizenship information for each general partner in the partnership. 37 C.F.R. §2.32(a)(3)(iii). This requirement also applies to a partnership that is a general partner in a larger partnership. See TMEP §803.03(b) for the proper format for identifying a partnership. Given the varying legal effects of partnership status in foreign countries, the relevance of the name and citizenship information for each partner has not been established. Therefore, for foreign partnerships, it is not necessary to provide the names and citizenship of the partners. See TMEP §803.03(i) for further information about foreign applicant entities.

For joint applicants or a joint venture, the application should set forth the citizenship or U.S. state or foreign country of organization of each party. See 37 C.F.R. §2.32(a)(3)(i)-(ii). Domestic joint ventures must also provide the name and citizenship information for all active members of the joint venture. 37 C.F.R. §2.32(a)(3)(iv). See TMEP §803.03(b) for the proper format for identifying a joint venture.

Section 66(a) Applications. In an application for international registration, the international application does not require the applicant to provide the entity and citizenship information. Regs. Rules 9(4)(b)(i)–(ii). However, when the information is included, the IB forwards it to the USPTO as part of the §66(a) application.

If the applicant is an individual, that is, a natural person, he or she must indicate his or her name and the country of which he or she is a national. If provided in the §66(a) application, this information appears in the Trademark database in the "Nationality of Applicant/Transferee/Holder" field, and the applicant’s citizenship is the country corresponding to the two-letter code set forth in this field. The list of country codes appears in the MM2 International Registration application form, which can be found at http://www.wipo.int/export/sites/www/madrid/en/forms/docs/form_mm2.pdf . The examining attorney should enter the entity and citizenship into the Trademark database, or send a request to the LIE to have it entered. A separate statement that applicant is an individual will not appear in TICRS, and the "Legal Nature" and "Legal Nature: Place Incorporated" fields will state "Not Provided." No inquiry as to the applicant’s entity or citizenship is necessary. The absence of the "Nationality of Applicant/Transferee/Holder" field means that the applicant is a juristic entity rather than an individual.

If the applicant is a juristic entity, the name, entity, and citizenship of the juristic entity is required. If provided in the §66(a) application, the entity and citizenship information appears in the "Legal Nature" and "Legal Nature: Place Incorporated" fields. If these fields state "Not Provided," the examining attorney must require the applicant to indicate its entity and citizenship.

Regardless of whether the applicant is an individual or a juristic entity, the examining attorney cannot rely on the "Entitlement Nationality," "Entitlement Establishment," or "Entitlement Domiciled" fields for the applicant’s citizenship because these fields merely indicate the basis for the applicant’s entitlement to file an application through the Madrid system, not the national citizenship of the applicant.

The application must specify the applicant’s domicile and email addresses. 37 C.F.R. §2.32(a)(2). Applicant must keep these addresses current and promptly update the USPTO when these addresses change.37 C.F.R §§2.23, 2.189. See TMEP §803.05(b) regarding certain filers that may be exempt from the requirement to provide an email address.

Applicants must provide and keep current the address of their domicile. 37 C.F.R §§2.32(a)(2), 2.189. An applicant’s domicile address is required for a complete application. 37 C.F.R §2.32(a)(2).

For a natural person, domicile is the permanent legal place of residence, which is the place the person resides and intends to be the person’s principal home. 37 C.F.R §2.2(o). For a juristic entity, domicile is the principal place of business, which is the entity’s headquarters where its senior executives or officers ordinarily direct and control the entity’s activities and is usually the center from where other locations are controlled. 37 C.F.R §§2.2(o) -(p). See TMEP §601.01 regarding determining domicile.

An applicant’s domicile address will determine whether the applicant is required to be represented before the USPTO by an attorney who is an active member in good standing of the bar of the highest court of a U.S. state, Commonwealth, or territory (a qualified U.S. attorney). 37 C.F.R §§2.11(a), 11.1, 11.14(e); see TMEP §§601, 602. An applicant whose domicile is not located within the United States or its territories must be represented by a qualified U.S. attorney. 37 C.F.R §2.11(a). An applicant whose domicile is within the United States or its territories may represent itself in prosecuting an application or may be represented by a qualified U.S. attorney. See TMEP §601 regarding representation requirements for mark owners based on domicile.

An applicant generally must provide its domicile street address. See 37 C.F.R §2.189. Domicile addresses should include the United States Postal Service ZIP code or its equivalent for addresses outside the United States. An address that does not identify an actual street address or that functions as a mail forwarding address generally may not serve as a domicile address. See TMEP §601.01(c) for more information.

The TEAS application forms include a dedicated field for the applicant’s domicile address and a separate field for the applicant’s mailing address. Only address information entered in the "Domicile Address" field on the TEAS form is hidden from public view. Therefore, if an applicant enters the same address in the TEAS form fields for its mailing address and its domicile address, that address will be publicly viewable.

For joint applicants, the application must set forth the domicile address for each party.

For a partnership, corporation, association, or other firm, only the domicile address of the business must be set forth and not the addresses of individual partners, officers, or members, unless the entity asserts it does not have a fixed physical address. See TMEP §601.01(c)(iv)(A) regarding the option for juristic entities asserting no fixed physical address to provide the name, title, and domicile address of a person with legal authority to bind the entity.

When necessary, the USPTO may require the applicant to furnish information or declarations to confirm the applicant's domicile address in order to determine if the applicant is subject to the requirement to be represented by a qualified U.S. attorney. 37 C.F.R §2.11(b). See TMEP §601.01(b) for more information.

Applicants must provide and maintain a valid email address. See 37 C.F.R §§2.23(b), 2.32(a)(2). The applicant’s email address is a filing-date requirement and is required even if the applicant has appointed a qualified U.S. attorney, so that the USPTO can contact the applicant if representation ends. See 37 C.F.R §2.21(a)(1); TMEP §202.

The applicant may provide an email address of its choice, including an email specifically created for receiving USPTO correspondence. If the applicant is represented by a qualified U.S. attorney, the email address listed in the owner field may not be identical to the listed email address of its attorney.

The email address listed in the owner field for trademark applicants who are represented by a qualified U.S. attorney will not be publicly viewable. Only the email address of the attorney will be publicly viewable, and the USPTO will use the attorney’s email address for correspondence.

The email address listed in the owner field for trademark applicants who are not represented by a qualified U.S. attorney will be used by the USPTO for correspondence and will be publicly viewable as the correspondence email address. To avoid receiving unsolicited communications at a personal or business email address, applicants may wish to create an email address specifically for communication and correspondence related to their trademark filings at the USPTO.

For in-house counsel and attorneys representing themselves in a matter, the TEAS forms will require two different email addresses: one for the owner email address field and one for the attorney email address field. For technical reasons related to the TEAS forms, these addresses cannot be identical.

Section 66(a) applications. The requirement for an applicant to provide and maintain a valid email address also applies to applications filed under Trademark Act Section 66(a). 37 C.F.R §§2.23(b), 7.25(a). This is not a filing-date requirement for an initial Section 66(a) application, because these are transmitted to the USPTO by the International Bureau (IB) and generally do not include an email address for receiving USPTO correspondence. In addition, if a Section 66(a) application is otherwise in condition for approval for publication upon first action, the examining attorney may approve the application for publication and should not require the applicant to appoint an attorney authorized to practice before the USPTO or to provide an email address. However, the applicant will be required to appoint an attorney authorized to practice before the USPTO and provide an email address in any subsequent submissions. See TMEP §601.01(a)regarding applicants with a non-U.S. domicile and §714.05 regarding the deadline within which all refusals and/or requirements must be notified to the IB.

Certain treaty filers exempt from email requirement. If the applicant is a national of a country that has acceded to the Trademark Law Treaty, but not to the Singapore Treaty on the Law of Trademarks, the requirement to provide the applicant’s email address does not apply. 37 C.F.R §§2.21(c), 2.23(c); see TMEP §301.02(c).

While an application can be amended to correct an inadvertent error in the manner in which an applicant’s name is set forth, an application cannot be amended to substitute another entity as the applicant. 37 C.F.R §2.71(d); TMEP §803.06. See TMEP §1201.02(c) for examples of correctable and non-correctable errors in identifying the applicant.

If the application was filed in the name of a party who had no basis for such party's assertion of ownership of the mark (or a bona fide intention to use the mark in commerce) as of the filing date, the application is void, and registration must be refused. 37 C.F.R. §2.71(d). Lyons v. Am. Coll. of Veterinary Sports Med. & Rehab., 859 F.3d 1023, 1027, 123 USPQ2d 1024, 1027 (Fed. Cir. 2017); Hole in 1 Drinks, Inc. v. Lajtay, 2020 USPQ2d 10020, at *9-10 (TTAB 2020); Norris v. PAVE: Promoting Awareness, Victim Empowerment, 2019 USPQ2d 370880, at *4-5 (TTAB 2019); Conolty v. Conolty O'Connor NYC LLC, 111 USPQ2d 1302, 1309 (TTAB 2014); TMEP §1201.02(b). The USPTO will not refund the application filing fee in such a case.

A void application filed in the name of a wrong party cannot be cured by amendment or assignment. See 37 C.F.R. §2.71(d); TMEP §1201.02(b). The true owner may file a new application (with a new filing fee) in its name or, if the applicant who is refused later becomes the owner of the mark, such party may file a new application (with a new filing fee) at that time.

See TMEP §803.01 regarding minor applicants and Chapter 500 and §1201.02(e) regarding the transfer of ownership from the true owner to another party after the filing date.

An application must include a statement that is verified by the applicant or by someone who is authorized to verify facts on behalf of an applicant. 15 U.S.C. §1051(a)(3), (b)(3); 37 C.F.R. §§2.32(b), 2.33(a), 2.193(e)(1).

In an application under §1 or §44 of the Trademark Act, a signed verification is not required for receipt of an application filing date under 37 C.F.R. §2.21(a). If the initial application does not include a proper verified statement, the examining attorney must require the applicant to submit a verified statement that relates back to the original filing date. See TMEP §§804.01-804.01(b) regarding the form of the oath or declaration, TMEP §804.02 regarding the essential allegations required to verify an application for registration of a trademark or service mark, and TMEP §804.04 regarding persons properly authorized to sign a verification on behalf of an applicant.

In §66(a) applications for a trademark or service mark, the verified statement is part of the international registration on file at the IB. 37 C.F.R. §2.33(e); see TMEP §§804.05, 1904.01(c).

See TMEP §1303.01(b)(i), §1304.02(b)(i), and §1306.02(b)(i) regarding the verified statement for a §1(a), §1(b), §44(d), or §44(e) basis for a collective or certification mark application, and TMEP §1303.01(b)(ii), §1304.02(b)(ii), §1306.02(b)(ii), and §1904.02(d) regarding the verified statement for a §66(a) basis for a collective or certification mark application.

Applications filed using the Trademark Electronic Application System (TEAS) include a declaration under 37 C.F.R. §2.20 as the form of verification. See TMEP §804.01(b) for more information about declarations.

For an application that is permitted to be filed on paper (see TMEP §301.01), the form of the verification in an application under Trademark Act §1 or §44 may be: (1) an oath (jurat) (see TMEP §804.01(a)); or (2) a declaration under 37 C.F.R. §2.20 or 28 U.S.C. §1746 (see TMEP §804.01(b)). See 37 C.F.R. §2.2(n).

The verification is placed at the end of the application. It should first set forth the venue; followed by the signer’s name (or the words "the undersigned"); then the necessary statements (TMEP §804.02); concluding with the signature. After the signature, there should be the jurat for the officer administering the oath, and an indication of the officer’s authority (such as a notarial seal).

The form of the verification depends on the law of the jurisdiction where the document is executed, so variations of the above form are acceptable. If there is a question as to the validity of the verification, the examining attorney must ask the applicant if the verification complies with the laws of the applicant’s jurisdiction. See TMEP §804.01(a)(i) regarding verifications made in a foreign country.

If the verification is notarized but does not include the notarial seal, the examining attorney must require a substitute affidavit or declaration under 37 C.F.R. §2.20.

If the verification is notarized but has not been dated, the applicant must submit either a statement from the notary public attesting to the date of signature and notarization, or a substitute affidavit or declaration under 37 C.F.R. §2.20.

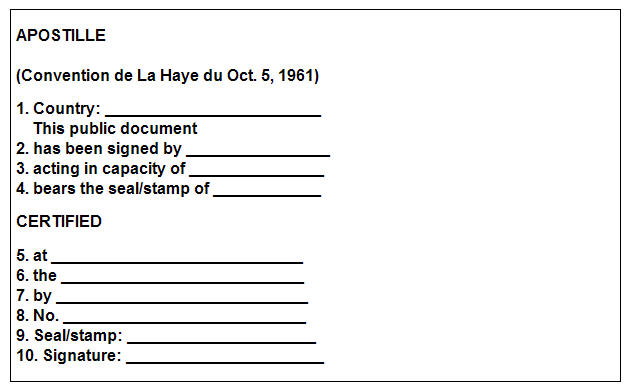

Verification (with oath) made in a foreign country may be made: (1) before any diplomatic or consular officer of the United States; or (2) before any official authorized to administer oaths in the foreign country. In those foreign countries that are members of The Hague Convention Abolishing the Requirement of Legalisation for Foreign Public Documents, opened for signature Oct. 5, 1961, 33 U.S.T. 883, 527 U.N.T.S. 189, a document verified before a foreign official should bear or have appended to it an apostille (i.e., a certificate issued by an official of the member country).

An apostille must be square shaped with sides at least 9 centimeters long. The following is the prescribed form for an apostille:

See 1013 TMOG 3 (Dec. 1, 1981).

If a verification is made before a foreign official in a country that is not a member of the Hague Convention, the foreign official’s authority must be proved by a certificate of a diplomatic or consular officer of the United States. 15 U.S.C. §1061.

Declarations under 37 C.F.R. §2.20 and 28 U.S.C. §1746 by foreign persons do not have to be made before a U.S. diplomatic or consular officer, or before a foreign official authorized to administer oaths. A declaration under 28 U.S.C. §1746 that is executed outside the United States must allege that "I declare (or certify, verify, or state) under penalty of perjury under the laws of the United States of America that the foregoing is true and correct." See TMEP §804.01(b).

See http://www.hcch.net/index_en.php?act=conventions.text&cid=41 for updated information about the Hague Convention Abolishing the Requirement of Legalisation for Foreign Public Documents.

Under 35 U.S.C. §25, the USPTO is authorized to accept a declaration under 37 C.F.R. §2.20 or 28 U.S.C. §1746 instead of an oath. These declarations can be used whenever the Act or rules require that a document be verified or under oath.

When the language of 37 C.F.R. §2.20 or 28 U.S.C. §1746 is used with a document, the document is said to have been subscribed to (signed) by a written declaration rather than verified by oath (jurat).

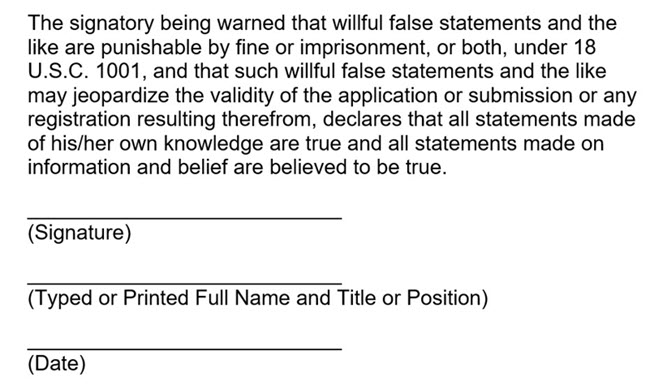

When a declaration is used in lieu of an oath, the party must include in place of the oath (jurat) the statement that "all statements made of his/her own knowledge are true and all statements made on information and belief are believed to be true." The language should be placed at the end of the document.

In addition, the declaration must warn the signatory that willful false statements and the like are punishable by fine or imprisonment, or both (18 U.S.C. §1001). 35 U.S.C. §25(b). Trademark Rule 2.20 requires that the warning contain the additional language that such statements may jeopardize the validity of the application or submission or any registration resulting therefrom. A declaration under 37 C.F.R. §2.20 should read as follows:

Instead of using the language of 37 C.F.R. §2.20, an applicant may use the language of 28 U.S.C. §1746, which provides as follows:

Wherever, under any law of the United States or under any rule, regulation, order, or requirement made pursuant to law, any matter is required or permitted to be supported, evidenced, established, or proved by the sworn declaration, verification, certificate, statement, oath, or affidavit, in writing of the person making the same (other than a deposition, or an oath of office, or an oath required to be taken before a specified official other than a notary public), such matter may, with like force and effect, be supported, evidenced, established, or proved by the unsworn declaration, certificate, verification, or statement, in writing of such person which is subscribed by him, as true under penalty of perjury, and dated, in substantially the following form:

(Signature)".

(Signature)".

NOTE: A declaration under Title 35 of the United States Code, which pertains specifically to the USPTO, is preferred to one under 28 U.S.C. §1746, which is a statute of general application relating to verification on penalty of perjury.

A declaration that does not attest to an awareness of the penalty for perjury is unacceptable. See 35 U.S.C. §25; In re Hoffmann-La Roche Inc., 25 USPQ2d 1539, 1540-41 (Comm’r Pats. 1992) (failure to include a statement attesting to an awareness of the penalty for perjury, which is the very essence of an oath, is not a "minor defect" that can be provisionally accepted under 35 U.S.C. §26), overruled on other grounds, In re Moisture Jamzz Inc., 47 USPQ2d 1762, 1764 (Comm’r Pats. 1997); In re Stromsholmens Mekaniska Verkstad AB, 228 USPQ 968, 970 (TTAB 1986) .

The signatory must personally sign his or her name. 37 C.F.R. §2.193(a)(1). It is not acceptable for a person to sign another person’s name to a declaration pursuant to a general power of attorney. See In re Dermahose Inc., 82 USPQ2d 1793, 1796-97 (TTAB 2007) ; In re Cowan, 18 USPQ2d 1407, 1409 (Comm’r Pats. 1990). If a TEAS submission is signed electronically, the person(s) identified as the signer(s) must personally enter the elements of the electronic signature. 37 C.F.R. §2.193(a)(2),(c)(1); In re Dermahose, 82 USPQ2d at 1795-97. See TMEP §611.01(c) regarding signature of documents filed through TEAS.

If a declaration under 37 C.F.R. §2.20 or 28 U.S.C. §1746 is not dated, the examining attorney must require the applicant to state the date on which the declaration was signed. This statement does not have to be verified, and may be entered through a Note to the File in the record.

See TMEP §804.02 regarding the essential allegations required to verify an application for registration of a mark.